January 24, 2022

I hope this letter finds you well. As I write to you, I am reflecting on how dramatically the world seems to have changed in just the first three weeks of 2022. Conversations seem to have shifted away from Covid and are centering more now on the increased prices we are paying at the store and gas pump and whether or not Russia will invade Eastern Europe. Thankfully, the Omicron variant seems to be less virulent but the transition away from overwhelming Federal support is driving higher interest rates and that is echoing through the financial markets. These uncomfortable gyrations reinforce the importance of having an investment process that fits your needs.

I would like to cover the following in this client note –

- Abnormal Behavior – The future continues to develop (space exploration, mRNA research, blockchain, web 3.0) but investor behavior is anecdotally pollyannish and not normal.

- Portfolio valuation – some core metrics

- Portfolio process

- Conclusions

Not Normal – A brief story and other anecdotes –

Our 8th grade son used his “savings” to buy a crypto “miner.”

He keeps us on our toes.

He is curious and plugged into technology trends like most any 13 year old boy. That part is normal, but his expectation that he will buy a device that plugs into our internet and magically prints money while he is at school is not.

He is motivated by money and always trying to figure out how to make more for his next purchase (examples from the past — 2nd gaming system, iTouch, One-Wheel, special gaming mouse/keyboard setup, etc). He gets a basic allowance from us, makes a little more for mowing, edging and blowing the yard and has occasional one-off jobs pressuring washing driveways in the neighborhood.

Crypto currency “mining” hit his radar earlier last year and all he can see is passive income. I do not fully understand it, but the premise is that a computer can run enough combinations to “unlock” another unit of a cryptocurrency and then that unit or coin is worth something in dollars. The idea then is that after buying a “miner” and paying for electricity, there is a profit leftover.

I was and am a skeptic that he can successfully execute a profitable mining operation for a host of reasons – the complexity of the premise, like what will the currency be worth if he can actually extract it, but also because he needs to go to school, do homework, practice sports, etc. vs. maintain and attend to the “miner.”

He kept pressing me to let him buy or invest in a “miner” and we relented as I sensed an opportunity for him to learn a lot, come what may. [Some context here is that we require the kids to put a portion of their earnings in “savings.” We will generally let them spend their “spend” money on most anything, but their savings is for “investment” vs. being able to spend it. To date, investment for them has been traditional and conservative, as they have not been all that curious yet.]

He was at $0 in his “spend” and started looking at the money he had in “save” and made the case that buying a “miner” was an investment. I had him draw up a spreadsheet to estimate things like how long will it take him to get paid back (he thinks four months), as well as build a PowerPoint deck to present the investment thesis.

In order to buy the miner he had to convert his dollars into a cryptocurrency and send them to the manufacturer/vendor. That was back in November. He did not expect to receive the device until April/May because of supply chain issues with semi-conductor chips. I cautioned him here, but he proceeded anyway.

The status then is that he has sent his money via a crypto currency to a vendor he has never done business within hopes of actually receiving a device five months later, in which he will use it to tap into some network to extract coins from the nethersphere and exchange them for dollars so that he can recoup his investment nine months from purchase and begin free-cashflowing from that point forward. I understand that many people have done very well in this endeavor in recent years, but a 13 year old boy making money on this ride “to the moon” is not normal and indicative of a swath of participants in the asset marketplace.

I hope he does great, for sure, but there is nothing else to report for now so stay tuned for an update this time next year.

Other examples I have observed of riskier investor behavior of late —

- An attorney shared with me that he has half of his net worth is in cryptocurrency;

- Investing in a crypto-currency hedge fund with a lock up clause;

- Friends investing in illiquid funds like private equity and leveraged low grade bonds;

- Local commercial real estate deals being consistently over-subscribed;

- Unsolicited calls every couple of weeks from realtors outside of the area with a client interested in buying our house;

- Clients’ high school aged children logging into their parents’ brokerage profile to buy and sell stocks during the school day;

- The percentage of US stocks trading above a price – sales ratio (an important valuation metric) of 10 far exceeding the technology bubble of the late 1990’s (a ratio of 2 is historically considered fair value);

- A friend listed her house in Richmond, VA for $500k and accepted an offer for $650k!

My sense is that the world is filled with holders of assets that primarily own them because their price has appreciated and have never really been tested by a long drawn-out environment of price declines punctured by periodic rallies of hope.

The justification for over-valuation in the high tech area of the stock market has partly been related to low interest rates since 2009, but also that more companies the last 20 years have opted to stay private for longer and the public stock market looks inexpensive compared to the valuations of the private market (There are a variety of reasons for this shift, like the regulatory increase of Sarbanes Oxley in the early 2000’s, as well as deeper pools of private equity investors that really accelerated during the Great Recession of 2008/9).

There is an index called the Wilshire 5000, which was established in 1974 to track 5,000 publicly traded US stocks. It peaked in the number of stocks it included in 1998 with 7,500 and today includes 3,687 (Investopedia).

I was listening to an interview recently on the podcast “Invest Like the Best” between host Patrick O’Shaughnessy (we have long followed O’Shaughnessy’s quantitative research) with a veteran investment manager, Ricky Sandler, and he had a couple key things to say about the environment —

“I think the prospect of looking at public and private is fundamentally a good thing. . . but ultimately the public market in the long run is going to be your arbiter for where these private companies need to go.”

His point is that the private investing market is likely in need of a pricing adjustment lower as opposed to it justifying high growth stocks trading at over-valued levels.

Valuations

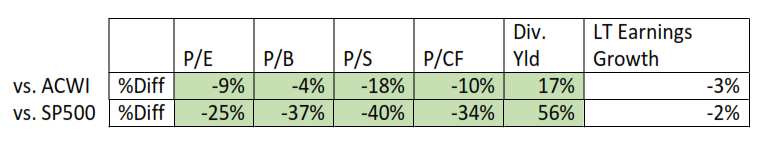

If we look at valuations, a typical client portfolio is “cheaper” or a better value than both a proxy for the global stock market (ACWI) as well as a proxy for the US stock market (S&P 500). The following core factors are reflected below – price-earnings (P/E), price-sales (P/S), price-cashflow (P/CF), dividend yield, and long-term earnings growth.

The model client portfolio is relatively attractive on all fronts while maintaining a comparable underlying earnings expectation. For example, the model client portfolio has a price-earnings ratio of 15.9, which is a 25% lower valuation than the S&P 500 index, which has one of 21.3.

Our Process – a Reminder

As I wrote last year at this time, we are employing a portfolio approach that is less dependent on technology stocks to continue to be the driver, has comparable earnings expectations on average and is priced today at a more attractive valuation.

A fairly valued stock portfolio does not mean it will not be tested from time to time, as stock markets broadly are down to get the year started, but we are trying to take what I like to call “respectful risk.”

We employ –

- Portfolio allocation that fits with where your needs are;

- Invest the bond portion in risk free treasuries, CDs and money funds for stability;

- Invest the stock portion primarily in a diversified manner that leans toward areas of value that are ultimately priced to grow at some point in the future;

- Re-balance periodically to either reduce stocks when they have grown too far above your target allocation or to add to stocks if they have come down too much below your target.

This simple, yet methodical approach is designed to ultimately keep pace with inflation, and then some, over time and allows us to take the environment one step at a time.

Conclusion

The whole premise of web 3.0 and next generation technology seems similar to the acceleration of the internet eco-system in the late 90’s where infrastructure was being laid by the likes of Global Crossing, WorldCom, Cisco, Microsoft, Intel, Lucent, etc, etc. The internet continued to develop and persist, but many of those companies involved in its expansion did not make it and the Nasdaq high growth stock index led the three year decline in stock prices and took years to recover. Other areas that were fairly valued got caught up in the events of the time, like the recession and twin towers terrorist attack, but ultimately recovered more quickly.

We’ll see how the next couple of years unfolds, but there is a whole class of investors that hold speculatively priced assets because prices have been favorable in recent years, trading expenses are very low and there is a self-reinforcing loop that many participants view the world through – the narrative of “interest rates are low and cash pays nothing, so over-valued stock prices are justified as revenues are the only metric and we believe in the future.”

The future of the internet and its convenience and efficiencies likely comes to fruition, but the faith of these new holders of these speculatively priced assets will likely be tested and maybe the start of it is just now happening. Similar parallels can be observed in the build out of the railroads in ~1900 and then the buildout of our electrical grid decades later.

As I mentioned in my early November note – “Shifting Seasons,” we have reasons to be encouraged about the economy the next couple of years (not a forecast, but a bias from our research, which includes Ned Davis Research and First Trust), yet we had gone over 400 days without a selloff in stock prices greater than 10%, when the average spacing between such setbacks is 251 days (Ned Davis Research).

As of this writing today, US stocks are down from their highs by 10%, so we are seeing the kind of volatility come through that happens from time to time. As a human person, I do not like experiencing it, but share this data as something that we have allowed for.

Ricky Sandler from the interview I referenced earlier had more to say about the context – “We are on the other side of something major (Federal Reserve meeting from November 2021). We had the most accommodative Fed anyone’s ever seen. And now the Fed is on a tightening cycle as far as the eye can see. . . That inflection point is really good for fundamental investors.”

We prefer owning a diversified portfolio that is fairly valued and allows for a variety of outcomes and plan to step methodically whether chaos continues to unfold in the speculative areas of the market or not.

Best,

David Maddux

CEO & Chief Investment Officer

david.maddux@brightwateradvisory.com

P.S. I shared the following last year, but think it is worth repeating. A wealthy client, who was successful in business while simultaneously having an appropriately short, but impactful, local political career taught me nineteen years ago about the benefits of manually tracking his balance sheet. There is another layer of awareness that seeps in when taking a few minutes annually to do this exercise. We have a “balance sheet” tracker spreadsheet that I have shared with many clients and I encourage you to contact us if you would like a copy.

P.P.S. An additional investing hack or technique is to reduce your liquid investment assets on your ledger by some % (I like to use ~15%), as well as show your real estate purchased in the last ~10 years at cost. You logically know that your $1million is $1million, but when you record it as $850,000, it can be sobering. This process seems to give permission that you can live through a market downturn and not panic.

Data source for style boxes and representative portfolios: Morningstar Office

Brightwater Advisory, LLC is an SEC registered investment adviser* with its principal place of business in Tampa, Florida. This letter contains general information pertaining to our advisory services. The information is not suitable for everyone and should not be construed as personalized investment advice. This letter contains certain forward‐looking statements (which may be signaled by words such as “believe,” “expect” or “anticipate”) which indicate future possibilities. Due to known and unknown risks, other uncertainties and factors, actual results may differ materially from the expectations portrayed in such forward‐looking statements. There is no guarantee that the views and opinions expressed in this newsletter will come to pass. Investing involves risk, including risk of loss, which an investor must be prepared to bear. We manage investments based upon factors which may include, but are not limited to, a client’s investment time horizon, income, net worth, attitude toward risk and investment knowledge. Therefore, it is important for clients to inform us promptly if there is a substantive change to his or her risk capacity, including financial situation. In addition, if goals and objectives have changed, please let us know immediately. Indices are unmanaged. Any reference to a market index is included for illustrative purposes only as it is not possible to directly invest in an index.

For additional information about us, please request our disclosure brochure as set forth on Form ADV using the contact information set forth herein, or refer to the Investment Adviser Public Disclosure web site at https://adviserinfo.sec.gov/.

*Registration as an investment adviser does not imply any level of skill or training.