We sent a letter to clients in January and I am sharing an edited version in which I would like to cover the following items in this note –

- Markets & Portfolios – added small companies; some core metrics

- Planning – “Donor Advised Fund” for strategic philanthropic giving and tax planning

- Further Reading

Markets and Portfolios

I learned a long time ago that there is always something to worry about in the stock market, but for a lot of reasons, it seems truer today. I am not surprised that markets hit an unknowable stumbling block this past year, but am certainly surprised at the speed of the stock market recovery. I will run through some context and then recap what we can control, like investing in a way that allows for a variety of short term stock market outcomes.

A year ago, I suggested that the risk of a recession was low based on a variety of factors and key third party research, but that stock valuations continued to be high, at least in the largest US companies. We entered 2020 with the majority of client portfolios mildly underweight stocks and ended the year at least market weight (on point for your stock target) or slightly overweight for most clients.

Leading stocks were technology or “growth” oriented going into 2020 and that theme persisted during this past year as technology stocks “grew eight years in eight months” with the immediate shift to staying home and in many cases working from home (Brian Wesbury). The result has been that this area of technology/growth has become more expensive and other areas are relatively attractive.

We made incremental re-balancing adjustments during the year (adding to stocks twice during the panic of Q1, reducing stocks during the summer price rebound and then counter-intuitively adding again just prior to the election as worries and COVID-19 numbers were rising again). These adjustments were primarily motivated by not wanting a portfolio to drift too hot or too cold relative to its stock target vs. trying to know what short term movements would be.

The net is that we –

- added stocks of smaller US companies for the first time in many years, at the expense of stocks of larger US companies and ended 2020 on target or mildly higher for most every client;

- maintained dividend-oriented stocks, which did not provide the cushion during the initial market panic, but generally recovered by year-end and make sense in this low interest rate world, particularly for income oriented clients;

- maintained a broadly diversified portfolio, including the stocks of internationally listed companies, with a slight bias toward stocks of companies showing relatively attractive valuation metrics.

Regarding bonds we –

- maintained a short-term risk free posture through individual treasury bonds, CD’s and money funds;

- added to the TIPS (treasury inflation protected securities) position via an ETF (exchange traded fund) that holds US treasury bonds designed to keep up with rising inflation.

The end result is a balanced approach that fosters flexibility. If stocks go up in the coming quarters then we expect clients to make progress. If they go down, then we expect to be able to re-balance and incrementally add to stocks. This balanced approach tends to lag during favorable stock periods, like the infatuation with all things technology in recent years, but also tends to mitigate some of the turbulence when stock prices and risky bond prices bungee jump off the edge.

I perceive our average client portfolios to be well-positioned and durable for a variety of stock market outcomes in the near-term.

Under the hood – one of the risks we are trying to mute or allow for is the concentration that we observe in the S&P 500 specifically, which is a popular proxy for the US stock market, but also in a second popular global proxy, the All Cap World Index (ACWI).

They have both become more concentrated than normal in just a handful of large US stocks; particularly in technology/growth.

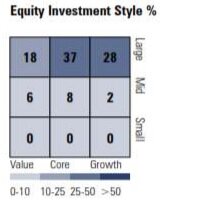

Of the 500 stocks that make up the S&P 500 84% fall into the large company category that is reflected in the y-axis below, with an overweight toward the “growth” stock area of the market, in the x-axis. The numbers of the grid total ~100% and the 28 in the top right reflect that 28% of this index of stocks is considered large company growth vs. 18% in large company value. This difference is due to the growth area leading the markets in recent years, leaving it expensive by most metrics and the value area relatively attractive.

(Source: Morningstar Office style boxes, which help investors think at the portfolio level and discern certain weightings in a portfolio that are either coincidental or intentional)

Furthermore, the largest five holdings (Apple, Microsoft, Amazon, Tesla and Facebook) comprise 20% and the largest ten holdings comprise 27%. Put another way, that means that 10/500 or 2% of the company’s stocks account for 27% of the price behavior. The current measurement has historically reflected a concentration peak, like the late 90’s with technology stocks and the early 80’s with energy stocks, for example (Wall Street Journal chart, 4/2020).

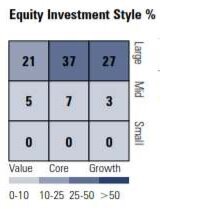

The second stock market proxy mentioned is the global index of the All Cap World Index (ACWI), which incorporates many of the stocks in the S&P 500, but is still large company oriented with an overweight toward the “growth” stock area of the market and the largest ten holdings influence 15% of the price behavior.

We view this concentration risk as a tail wagging the dog in the overall stock markets and implies a rigid outlook that technology/growth stocks are the only pathway to the promised land. We think it makes sense to incorporate many growth opportunities, relatively attractive valuations and flexibility. In today’s age it is simple to efficiently diversify away this concentration risk, by employing other index funds to invest the stock allocation.

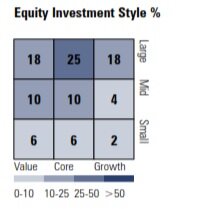

For example, our typical client portfolio is ~60% large company vs. the 85% we just detailed in the stock market proxies, as we have incorporated the stocks of smaller companies. The distribution is more balanced and has a slight bias to the “value” area of the markets vs. the “growth.” Finally, the top ten holdings account for ~6% of the overall portfolio vs. the 27% and 15% we highlighted earlier in the stock market proxies.

Not every client is exactly the same and many are different for a variety of reasons, like tax implications or inheritance, but the grid below is representative of how we are implementing.

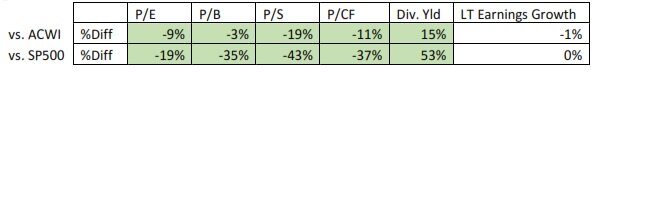

Finally, if we look at valuations, a typical client portfolio is “cheaper” than the US stock market as well as the global market by a margin on core factors like price-earnings (P/E), price-sales (P/S), price-cashflow (P/CF), has a higher dividend yield and comparable long-term earnings growth.

In sum, we are employing a portfolio approach that is less dependent on technology stocks to continue to be the driver, has comparable earnings expectations on average and is priced today at a more attractive valuation.

I do not know when this gap closes in the marketplace, if ever, but our diversified approach is rooted in long-term academic research and is a practical way to move toward a future that ends up being okay in the coming years, while the world works through the near-term fog of COVID-19, politics and social tension.

Planning / Donor Advised Funds

We have had more client needs for donor advised funds and I continue to be intrigued with their possibilities in financial planning, tax planning, life planning and practicing generosity. Our associate, Barry Brindise, has written the following summary for your review.

There are plenty of ways to donate to charity and “Donor Advised Funds” are rapidly gaining in popularity as they have become much easier to administer. Many custodians have created easy to open and easy to give charitable account capabilities. For example, at Schwab, you can open an account with a minimum irrevocable contribution of $5,000. Contributions can be in cash or non-cash assets like appreciated public company stock or even real estate. The entire amount you contribute is eligible for a tax deduction so long as you “itemize” in the same tax year. Annual custodial account administration fees at Schwab start at the greater of 0.60% of assets or $100.00. Brightwater will not charge any administrative fees for these accounts with balances less than $250,000.

How Do Donor Advised Funds Work?

Continuing the Schwab example, after you have opened your account, which can take just ten minutes to apply online, you can make additional contributions at any time and you can invest your contributions for potential growth through the use of what Schwab calls Core Account Investments which include pre-allocated pools labeled from “Conservative” to “Growth”. Gains and income in the account are not taxed and thus increase the balance you can grant to charity over time. If you do not regularly itemize deductions for you federal taxes, then making a larger contribution in a single year in which you will itemize will be much more tax efficient than smaller contributions across several years. You can still spread your grants to charities over multiple years.

When it comes to giving to charity, you can direct grants as little as $50 at any time to any IRS-qualified 501(c)(3) organization. To help with research and verify charitable organizations, Schwab offers access to GuideStar® , a national database of almost 2 million charitable organizations. Once you have named your charities, Schwab generates personalized letters featuring your own custom letterhead and they mail the checks, keep track of your contributions and grants, and compile an annual report for you at tax time.

When you contribute to a donor advised fund, you are making a charitable donation to a 501(c)(3) tax-exempt public charity. Consequently, you are entitled to receive the maximum tax deduction allowed by law. Contribute cash or investments without paying capital gains taxes. When making contributions, it is best to donate highly appreciated assets you have held for greater than one year. This type of contribution will both increase the value to your charity while maximizing your tax benefit. Asset type and holding period will affect your tax deduction so please consult with your tax preparer as you evaluate your contribution and granting options.

Brightwater Advisory can help you in all aspects of your personalized Donor Advised Fund from opening the account at Schwab to granting to charity and we can also help keep your donated account allocated between equities and fixed income assets consistent with your risk tolerance.

If you are interested in learning more, please feel free to contact Barry or me directly and if it makes sense to move forward, we will bring Misty Hooks, our Operations Manager, into the mix to help put this tool in place.

Further Reading – We have had enough inquiries about book suggestions at different times that I thought it would be good to include –

Financially Fit: Total Money Makeover by Dave Ramsey

Measurements of investment opportunities: What Works on Wall Street

by James O’Shaughnessy

Allocating Among Assets:

Investor’s Manifesto by William Bernstein

Rational Expectations: Asset Allocation for Investing Adults by William Bernstein

Quick Reads and Stories about Investing:

If You Can: How Millennials Can Get Rich Slowly by William Bernstein

Richest Man in Babylon by George Clason

Entrepreneurship: E-Myth Re-visited by Michael Gerber

Charity / Philanthropy: Paradox of Generosity by Christian Smith and Hilary Davidson

I would be surprised if one client read all of these, but you might find one or two you like, as well as one or more would make a good gift for someone else in your life.

Finally, on a personal note, I thought I would share an exercise that has been interesting and pleasantly surprising. I ran across a technique around intentional living three years ago that requires you to pick a word for the year. It can be most any kind of word, like “forward,” “curiosity,” “focus,” or “kind.” I am picking a new word for this year, but the word I picked in 2019 was “joy.”

It has been an intriguing exercise. I shared it with my wife, Katie, and our children, as well as a few close friends. I did not do anything formally except add it to my calendar as a weekly recurring item to keep it top of mind. Sometimes I would look for a book or an article intentionally to learn more about “joy,” but mainly it seems that I began to notice more things that pointed toward “joy,” like a Twitter post, an article, something that happened positive or my non-negative reaction to a negative event. There has been a mysterious attractive experience of sitting with and getting to know this word.

I am on the cusp of picking my word for this year and pass it along as a simple exercise that you might want to try.

As usual, please let me know what questions we can clarify. We appreciate the opportunity to help you follow through on good financial decisions.

Happy New!

David Maddux

CEO & Chief Investment Officer

david.maddux@brightwateradvisory.com

P.S. A wealthy client, who was successful in business while simultaneously having an appropriately short, but impactful, local political career taught me eighteen years ago about the benefits of manually tracking his balance sheet. There is another layer of awareness that seeps in when taking few minutes annually to do this exercise. We have a “balance sheet” tracker spreadsheet that I have shared with many clients and I encourage you to contact us if you would like a copy.

P.P.S. An additional investing hack or technique is to reduce your liquid investment assets on your ledger by some % (I like to use ~15%), as well as show your real estate purchased in the last ~10 years at cost. You logically know that your $1million is $1million, but when you record it as $850,000, it can be sobering. This process seems to give permission that you can live through a market downturn and not panic.

Data source for style boxes and representative portfolios: Morningstar Office

Brightwater Advisory, LLC is an SEC registered investment adviser* with its principal place of business in Tampa, Florida. This letter contains general information pertaining to our advisory services. The information is not suitable for everyone and should not be construed as personalized investment advice. This letter contains certain forward‐looking statements (which may be signaled by words such as “believe,” “expect” or “anticipate”) which indicate future possibilities. Due to known and unknown risks, other uncertainties and factors, actual results may differ materially from the expectations portrayed in such forward‐looking statements. There is no guarantee that the views and opinions expressed in this newsletter will come to pass. Investing involves risk, including risk of loss, which an investor must be prepared to bear. We manage investments based upon factors which may include, but are not limited to, a client’s investment time horizon, income, net worth, attitude toward risk and investment knowledge. Therefore, it is important for clients to inform us promptly if there is a substantive change to his or her risk capacity, including financial situation. In addition, if goals and objectives have changed, please let us know immediately. Indices are unmanaged. Any reference to a market index is included for illustrative purposes only as it is not possible to directly invest in an index.

For additional information about us, please request our disclosure brochure as set forth on Form ADV using the contact information set forth herein, or refer to the Investment Adviser Public Disclosure web site.

*Registration as an investment adviser does not imply any level of skill or training.