Life has been unnatural and shows no signs of lifting for the foreseeable future, at least in Florida. I want to cover the following items in this letter –

- Four truths of investing

- Know thyself

- Certainty of technology

- Role of stocks

- What we at Brightwater have been doing

- Housekeeping

- Health

My Morningstar Advisory Board meeting in Chicago scheduled for June was shifted to a “virtual” setting, like many events in our lives. They presented one of their new financial planning tools and the presenter reminded us how unnatural investing can be. First, when you invest capital, you are deferring your gratification to use that money today for something in the future, which goes against most people’s normal desires. Secondly, when you invest your money, you are accepting to live with uncertainty.

When we overlay the unnatural dynamics of living through a virus outbreak, on top of these unnatural aspects to investing, it makes sense that emotions and anxieties can compound on themselves.

Four Truths of Investing – I enjoy reading broadly but find it critical to do so during seasons of stress, whether personal or professional. News and current analysis need to be carefully curated and reviewed, but I find myself returning to a variety of books that have stood the test of time. Charles Ellis is founder of Greenwich Associates and former faculty member of Harvard Business School and Yale School of Management. His foreword to the fourth edition of Asset Allocation: Balancing Financial Risk by Roger Gibson (first edition foreword was written by Sir John Templeton) is worth reviewing –

Experienced investors all understand four wonderfully powerful truths about investing, and wise investors govern their investing by adhering to these four great truths –

- The dominant reality is that the most important decision is your long-term mix of assets – how much in stocks, real estate, bonds or cash.

- That mix should be determined by the real purpose and time of use of money.

- Diversify with each asset class—and between asset classes. Bad things do happen—usually as surprises.

- Be patient and persistent. Good things come in spurts—usually when least expected.

… [Individuals] are then free to devote their time and energy to the one role where they have a decisive advantage – knowing themselves and accepting markets as they are—just as we accept weather as it is—and designing a long-term portfolio structure or mix of assets that meets important tests—- The investor can and will live with it.

- The long-term, reasonably expectable results will meet the investor’s own priority.

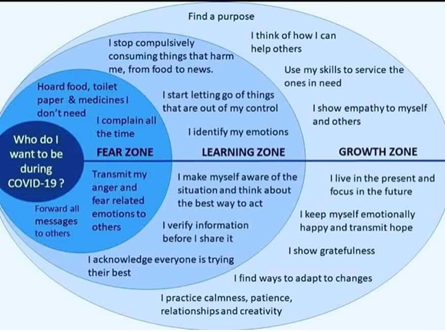

Know thyself – It is this “know thy-self” quality which is the key that each of us can focus on. Interestingly, the crucible of COVID-19 living illuminates this across several levels—in our community, in relationships, etc. I have found this graphic to be helpful in keeping tabs on myself , as I assess my current state from time to time and am reminded of wanting to live toward the “Growth Zone” (from Holly Donaldson Financial Planning) –

It’s thus important, financially speaking, for you and our team to grow in our understanding of each other. Working together over time, we are able to apply and update our analysis of your finances. We can then use judgement to mutually think through your ability to make it through extreme markets that tend to more often than not be marked by uncertainty, and can sometimes, surprisingly, lead us to a sense of “certainty”.

The “certainty” of today is a growing perception that the only stocks worth investing in are “Growth” and Technology oriented. It is hard to know exactly where we are in this cycle, but it reminds me of when I entered the investment advisory business in the late ‘90’s. The certainty of that period was that technology was the present and the future and those stocks would grow to the sky and beyond. That certainty was continually reinforced -until it wasn’t, and not only did that area collapse, but it was an excruciating ~three years until price lows were finally set. Frustratingly, the other regular stocks, that had not participated in the parabolic run up, actually did okay during that technology bust, but it seemed that many investors did not participate, as they had been seduced by the siren song of technology vs. strapping themselves to the mast of diversification.

This comment on “growth” stocks and “technology” is neither a short-term forecast nor a harbinger of loss, but an example of trying to figure out what we know vs. what we think we know in this environment. The stock market has witnessed a dramatic recovery since March, fueled by a handful of technology stocks. There is a “winner take all” sentiment and, as a result, valuations have become even more lop-sided. This has resulted in a historically high degree of concentration (or share of overall market) by a handful of stocks. Which leads me to another excerpt, which is from a blog post Jason Lina, a friend and colleague, recently published on his firm’s website, www.goldenbellfp.com.

“Most investors do not care about diversification, high grade bonds, re-balancing, uncorrelated investments and maintaining an appropriate risk level when stock markets are going up. All these things are boring and frustrating when stocks are advancing. But these same concepts are the hallmark of a strong investment approach and they earn their value during periods of heightened market stress.”

Role of stocks – Equities protect our savings against inflation, which over time, can eat away at the purchasing power of a retirement plan or of a savings, such as funding an education. That is true even of today’s lower rate of inflation of around 2%. Investing in a diversified stock approach mitigates inflation through dividend income, which has increased on average at a rate faster than inflation. Increasing dividends then are a signal that earnings are increasing and have historically led to stock prices rising over time, albeit in a lurching fashion, as some years are down.

What we at Brightwater Advisory have been doing – For most clients, we re-balanced twice in the first quarter, incrementally buying stocks during March in small amounts and then re-balanced twice in the second quarter, incrementally selling stocks in small amounts. This step is part of our normal process to manage within the guard rails of each client’s Investment Plan and associated target allocation but was accelerated due to the dramatic decline in prices during Q1 and the dramatic rise in prices during Q2. This simple and robust process allows us to maintain calmness during a wildly fluctuating market.

Housekeeping – We have included the new Client Relationship Summary Form (Form CRS), which we filed with the Securities Exchange Commission (SEC) last month. We applaud this new initiative from them for SEC registered investment advisers, to better and more clearly summarize how we operate in two pages or less.

Health – We are specifically involved in the health of your finances, which means that at times we have a unique perspective, as money tends to touch on many areas of life. That being said, in these unnatural times, if you are wanting or needing other counseling and coaching, like family/marital, spiritual or business, we know several other professionals in these areas and would welcome the opportunity to introduce you to one of them.

Our nation is working through a challenging time. We all are hopeful that we will get through this season sooner rather than later, but we will get through it. I know that I look forward to a natural, social future again, even if some of the normal is different. I want to reassure you that in the meantime, we will continue to practice patience and work prudently with you and your savings.

Please call or write with questions or to find a time to meet over phone or video.

Best,

David Maddux

CEO & Chief Investment Officer

David.Maddux@brightwateradvisory.com

We have provided this information regarding your account(s) based on sources we believe to be reliable and accurate. We urge you to take a moment to compare the account balances contained in this report to those balances reflected on the statements that you receive directly from your account’s custodian. Please contact us or the account custodian with any questions you may have. Also, please notify us promptly if you do not receive statements on all accounts from the custodian on at least a quarterly basis.

Brightwater Advisory, LLC manages your investments based upon factors which may include, but are not limited to, your investment time horizon, income, net worth, attitude toward risk and investment knowledge. Therefore, it is important for you to inform us promptly if there is a substantive change to your risk capacity, including your financial situation. In addition, if your goals and objectives have changed, please let us know immediately.

Unless otherwise indicated, all performance returns included in this report are net of advisory fees, transaction costs and custodial expenses. Returns for periods greater than one year are annualized. Past performance is not a guarantee of future results, and there is no guarantee against loss in a portfolio.